Will Bankruptcy Ruin My Credit Score?

If you are considering bankruptcy, you might be concerned that doing so will negatively affect your credit score. This concern is understandable. Bankruptcy misinformation is constantly pushed on consumers in hopes of deterring them from filing bankruptcy and discharging their debt. Many people are under the impression that filing bankruptcy will only negatively impact their credit score, but our clients consistently report that filing bankruptcy has improved their scores, and dramatically.

If you are considering bankruptcy, you might be concerned that doing so will negatively affect your credit score. This concern is understandable. Bankruptcy misinformation is constantly pushed on consumers in hopes of deterring them from filing bankruptcy and discharging their debt. Many people are under the impression that filing bankruptcy will only negatively impact their credit score, but our clients consistently report that filing bankruptcy has improved their scores, and dramatically.

Although you may have heard that bankruptcy will destroy your credit score for a long time, that does not have to be the case and often is not. In the long run, and even in the short term, many people will actually see improvements in their credit scores. A skilled bankruptcy attorney can advise you on what to expect if you file bankruptcy.

How Does Bankruptcy Affect Credit Scores?

Bankruptcy may negatively impact credit scores, but not always. If your credit score is negatively impacted, most of that negative impact will likely be limited to the time period soon after filing. It is also true that bankruptcy remains on your credit report for up to 10 years, but that does not prevent pre-filing credit scores from improving, especially over the long term..

However, because bankruptcy also discharges your debts, it may actually increase your credit score in the long run and possibly even immediately. In fact, studies have found that average credit scores improve by 69 points just one month after filing for bankruptcy. This happens for a few reasons such as the fact that:

-

Credit reports do not only factor in one negative effect such as bankruptcy, but rather are based on the whole credit picture.

-

When your debts are discharged in bankruptcy, your debt-to-income ratio improves, which improves your overall score and lowers your late payment history over time.

-

Bankruptcy gives you the opportunity to pay remaining bills on time, improving scores.

What Factors Impact How My Credit Score Will Do in Bankruptcy?

How bankruptcy impacts your credit score will depend on a number of factors including:

-

Your credit score at the time of filing: Low credit scores tend to improve with bankruptcy, while higher credit scores can be more negatively impacted.

-

Other recommended steps you take to improve your credit score after filing for bankruptcy, such as credit-building accounts

-

Which type of bankruptcy you file: Chapter 7 and Chapter 13 can have different effects on credit.

How Soon Will My Credit Score Improve After Bankruptcy?

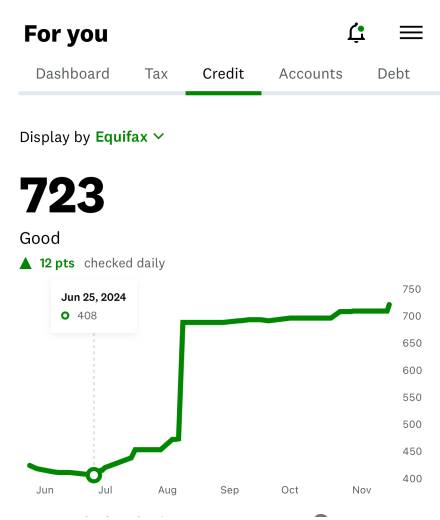

Bankruptcy may improve your credit scores soon after your debts are discharged. For example, it may be that if you file for bankruptcy in January, and your debts are discharged by April, you will see a dramatic improvement in credit scores soon after that. The photo at the top of this blog is a real result from a real Acker Warren P.C. client who filed for bankruptcy and saw his score improve over 300 points just a few months after filing. This is not an unusual result. Many clients see their scores improve by 100 points or more a month after filing for bankruptcy.

What Can I Do to Maintain and Increase My Credit Score:

To maintain and increase the credit score following bankruptcy, it is recommended to:

-

Continue paying bills on time

-

Review your credit reports

-

Open a new credit card

-

Keep credit card balances low

Contact a Dallas, TX Bankruptcy Attorney

Your credit score is an important part of your financial life, and at Acker Warren P.C. we understand that you might be concerned about how filing for bankruptcy will affect your credit score. The experienced Fort Worth, TX bankruptcy lawyer can help you navigate the bankruptcy process and understand how it may affect your credit score–before, during, and after bankruptcy. Call the office at 817-752-9033 for a free and confidential consultation today.