Recent Blog Posts

What to Expect After Bankruptcy

Filing bankruptcy can provide a powerful fresh financial start by discharging suffocating debts when responsibly managing obligations alone overwhelms abilities. However, given its notorious social stigmas plus lingering legal impacts, future life requires attentive navigation. It is beneficial to understand bankruptcy’s aftermath and how it can lead to new beginnings. A Texas bankruptcy attorney can help you figure out the most ideal chapter of bankruptcy for your situation.

Filing bankruptcy can provide a powerful fresh financial start by discharging suffocating debts when responsibly managing obligations alone overwhelms abilities. However, given its notorious social stigmas plus lingering legal impacts, future life requires attentive navigation. It is beneficial to understand bankruptcy’s aftermath and how it can lead to new beginnings. A Texas bankruptcy attorney can help you figure out the most ideal chapter of bankruptcy for your situation.

Rebuild Credit Responsibly But Realistically

Bankruptcy impacts credit scores, dropping averages by 130-150 points initially, and can linger for up to a decade, so traditional credit remains restricted requiring diligent reestablishment of responsible usage showing financial accountability now. Obtain secured cards that demonstrate the ability to handle timely monthly payments. Temporarily limit new revolving account pursuits while aggressively verifying the accuracy of all bankruptcy-related reporting. Consistent diligence earns increasing rewards enabling renewed access to future mortgages, auto loans, and credit cards over time through disciplined rebuilding.

How Chapter 13 Bankruptcy May Help When Behind on Child Support

Falling behind on child support payments can quickly snowball out of control between steadily accumulating monthly amounts owed, interest charges, penalties, and aggressive collection actions. However, parents struggling with past-due child support may find relief through using Chapter 13 bankruptcy.

Falling behind on child support payments can quickly snowball out of control between steadily accumulating monthly amounts owed, interest charges, penalties, and aggressive collection actions. However, parents struggling with past-due child support may find relief through using Chapter 13 bankruptcy.

While it does not discharge unpaid support, Chapter 13 allows you to repay arrearages over time through an affordable, court-supervised repayment plan. A Texas attorney can help determine if this is an ideal option for you.

The Benefits of Filing Chapter 13 Bankruptcy

Chapter 13 bankruptcy allows you to restructure debts under court protection while repaying a portion of what you owe over time. This contrasts Chapter 7 bankruptcy which completely discharges qualifying debt. The major advantage to a Chapter 13 is being able to catch up on back payments owed to creditors, including making up missed child support payments. Your repayment plan outlines an affordable monthly amount to creditors. Having this court-ordered structure can provide much-needed flexibility when juggling debt obligations.

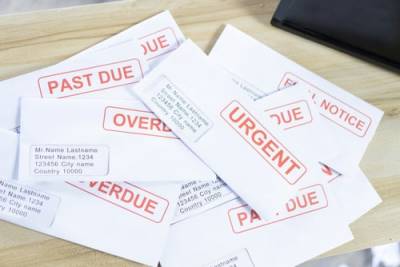

Fighting Back Against Abusive Debt Collectors Through Bankruptcy

Struggling with growing debt obligations while enduring threatening collection calls and letters can make daily life feel unbearable. Professional debt collectors are required to follow fair practices per the federal Fair Debt Collection Practices Act and the Texas Debt Collection Act. However, many continuously disregard the law and start harassing communications that violate borrowers’ rights. When you feel bombarded, mistreated, and unable to keep up with payments plus interest, leveraging bankruptcy may offer critical protection. A lawyer in Texas can help you determine the next step for your specific situation and what to do about this.

Struggling with growing debt obligations while enduring threatening collection calls and letters can make daily life feel unbearable. Professional debt collectors are required to follow fair practices per the federal Fair Debt Collection Practices Act and the Texas Debt Collection Act. However, many continuously disregard the law and start harassing communications that violate borrowers’ rights. When you feel bombarded, mistreated, and unable to keep up with payments plus interest, leveraging bankruptcy may offer critical protection. A lawyer in Texas can help you determine the next step for your specific situation and what to do about this.

Illegal and Unethical Collection Tactics

While collectors cannot legally deceive, misrepresent facts, or deploy harassment techniques, far too many break the rules, including through:

Can You Legally Get Out of a Personal Loan in Texas?

Taking out a personal loan provides fast access to cash when you need it. But if you fall behind on payments, the crushing debt can feel inescapable. Are there any legal avenues for relief from an overwhelming personal loan in Texas? You have a few options, but each has pros and cons to weigh carefully. A Texas lawyer can help you sort out your best options.

Taking out a personal loan provides fast access to cash when you need it. But if you fall behind on payments, the crushing debt can feel inescapable. Are there any legal avenues for relief from an overwhelming personal loan in Texas? You have a few options, but each has pros and cons to weigh carefully. A Texas lawyer can help you sort out your best options.

File for Bankruptcy

One way to legally discharge personal loan debt is through bankruptcy. The two primary bankruptcy routes in Texas are Chapter 7 and Chapter 13:

- Chapter 7 liquidates assets to pay creditors and eliminates remaining debts, including personal loans. To qualify, you must pass a ‘means test’ based on income and expenses. While it discharges the debt, a Chapter 7 bankruptcy can severely damage your credit for years.

- Chapter 13 restructures debts like personal loans into a 3-5 year repayment plan based on disposable income. This halts collections and gives you time to pay. But if you default on trustee payments, collections resume along with potential credit impacts.

Trapped in Never-Ending Payday Loan Debt? Learn Your Options

Payday loans carry shockingly high interest rates, often trapping borrowers in impossible-to-break cycles of growing debt. Thankfully, Texas law does provide options to regain control when payday loan payments become unmanageable burdens. A Texas lawyer can help you find out what options you may have for your specific situation and how you may be able to get out of it.

Payday loans carry shockingly high interest rates, often trapping borrowers in impossible-to-break cycles of growing debt. Thankfully, Texas law does provide options to regain control when payday loan payments become unmanageable burdens. A Texas lawyer can help you find out what options you may have for your specific situation and how you may be able to get out of it.

Understanding the Debt Trap Model

Payday lenders issue small, short-term loans at astronomical rates averaging 400-800% APR. Borrowers unable to repay in full within the very short duration of 2-4 weeks are forced to continually roll over the loan while paying only the excessive interest and fees. Lenders falsely claim these are “fees” rather than interest to cover up those fine print details. Harsh late penalties increase the balance even more. The debt quickly snowballs into a practically unpayable amount through this intentional business model.

Fighting Wrongful Foreclosure in Texas

If you are a homeowner facing foreclosure in Texas and believe the proceedings against your property are wrongful or invalid, there are legal strategies you can pursue to contest the process and protect your rights. A Texas lawyer can help you with the steps on how to do this.

If you are a homeowner facing foreclosure in Texas and believe the proceedings against your property are wrongful or invalid, there are legal strategies you can pursue to contest the process and protect your rights. A Texas lawyer can help you with the steps on how to do this.

Common Grounds for Wrongful Foreclosure Claims in Texas

Homeowners may have a case to challenge a foreclosure based on procedural defects by the mortgage holder or servicer, such as:

- Failure to properly provide notice of default and intent to accelerate as required by Texas statute

- Not adhering to statutory timelines for filing notice with the county clerk

Can I Get My Car Back by Filing Chapter 13 Bankruptcy?

Filing for bankruptcy can be a daunting and complex process, with various chapters offering different solutions to financial challenges. For people struggling with overwhelming debts and the fear of losing their vehicle through a repossession, Chapter 13 bankruptcy might provide a potential solution. If your car has been taken away in the last ten days or you are concerned that it may be taken and you live in Texas, our lawyers can help you file for Chapter 13 so that you can get your car back. Here is how.

Filing for bankruptcy can be a daunting and complex process, with various chapters offering different solutions to financial challenges. For people struggling with overwhelming debts and the fear of losing their vehicle through a repossession, Chapter 13 bankruptcy might provide a potential solution. If your car has been taken away in the last ten days or you are concerned that it may be taken and you live in Texas, our lawyers can help you file for Chapter 13 so that you can get your car back. Here is how.

Understanding Chapter 13 Bankruptcy

Chapter 13 Bankruptcy, also known as a wage earner’s plan, allows people with regular income to restructure their debts and create a manageable repayment plan. Unlike Chapter 7 bankruptcy, which involves liquidating assets, Chapter 13 focuses on debt reorganization and repayment over three to five years.

What is Unsecured Debt in Bankruptcy Law?

Bankruptcy is a legal process that provides individuals and businesses with a fresh start by eliminating and restructuring their debts. When navigating bankruptcy, it is essential to understand the distinction between secured and unsecured debt. If you are involved in bankruptcy proceedings in Texas, contact a lawyer to ensure your rights are protected as you move through the bankruptcy process in Texas.

Bankruptcy is a legal process that provides individuals and businesses with a fresh start by eliminating and restructuring their debts. When navigating bankruptcy, it is essential to understand the distinction between secured and unsecured debt. If you are involved in bankruptcy proceedings in Texas, contact a lawyer to ensure your rights are protected as you move through the bankruptcy process in Texas.

Definition of Unsecured Debt

Unsecured debt refers to any debt that is not supported by collateral or a specific asset. Unlike secured debt, which is tied to a specific property (such as a mortgage or car loan), unsecured debt is not directly linked to any particular asset. Examples of common unsecured debts include credit card debt, medical bills, personal loans, and certain types of student loans.

Avoiding Debt Traps with Payday Loans in Texas

Fast cash needs may make payday loans look like a quick fix. But these short-term loans' high fees and interest rates can spell trouble for borrowers. Repaying on time gets harder when extra costs pile up, starting a debt cycle that is a struggle to escape.

Fast cash needs may make payday loans look like a quick fix. But these short-term loans' high fees and interest rates can spell trouble for borrowers. Repaying on time gets harder when extra costs pile up, starting a debt cycle that is a struggle to escape.

What Rules Exist for Payday Loans in Texas?

Texas regulates payday lending but does not cap fees or interest. With no limits, costs can soar and make repayment within the loan term tougher for borrowers. Payday loans typically range from $100 to $1,000 and are due when the borrower's next paycheck arrives. Failing to repay on time can mean extra fees to extend the loan or taking out a new one to cover the old debt. This can quickly add up and lead to an unmanageable situation.

Seeing the Risks of Payday Loans

The steep fees and rates on payday loans can prevent borrowers from paying them off by the due date. This starts a cycle of borrowing and debt that's hard to break.

Common Mistakes To Avoid When Filing For Bankruptcy in Texas

Bankruptcy proceedings, often seen as a last resort during severe financial adversity for individuals and businesses, can paradoxically offer a lifeline and the opportunity for a fresh start if managed correctly. Here are eight common mistakes to avoid if you need to file for bankruptcy in Texas.

Bankruptcy proceedings, often seen as a last resort during severe financial adversity for individuals and businesses, can paradoxically offer a lifeline and the opportunity for a fresh start if managed correctly. Here are eight common mistakes to avoid if you need to file for bankruptcy in Texas.

Dismissing Bankruptcy as a Potential Debt Management Solution

Bankruptcy can strike fear in many, given its stigma and possible repercussions on your credit record, deterring you from exploring this avenue. However, outright refusal to consider bankruptcy a potential solution could prolong your financial difficulties. Bankruptcy can allow the restructuring or even eliminate some debts, marking it as a feasible strategy in numerous scenarios.

Procrastinating and Hesitating

A recurring error is waiting too long or deferring the choice to file for bankruptcy. This often leads to people incurring late charges, penalties, and accrued interest, which compounds their financial plight. It is imperative to consult a legal expert promptly when your debts appear unmanageable to circumvent the problem's escalation.